How Regular Account Reconciliation Enhances Cash Flow Management

Effective cash flow management is vital for the success and sustainability of any business. In the bustling economic landscape of Dubai, companies face constant challenges to maintain liquidity and plan for future growth. Regular account reconciliation is a powerful tool that not only ensures financial accuracy but also provides crucial insights into cash flow patterns, helping businesses avoid liquidity issues and achieve long-term financial stability. At Young and Right, we specialize in transforming your reconciliation process into a strategic asset for superior cash flow management.

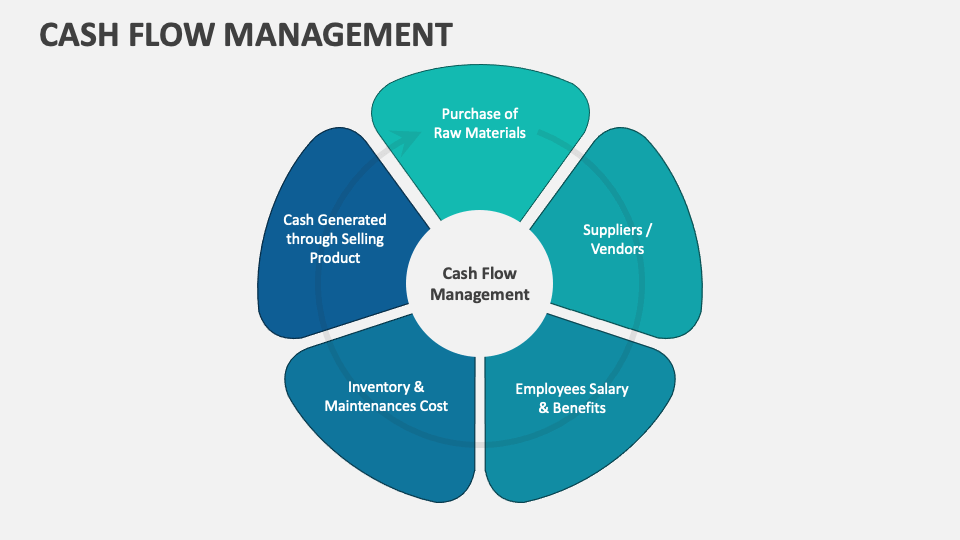

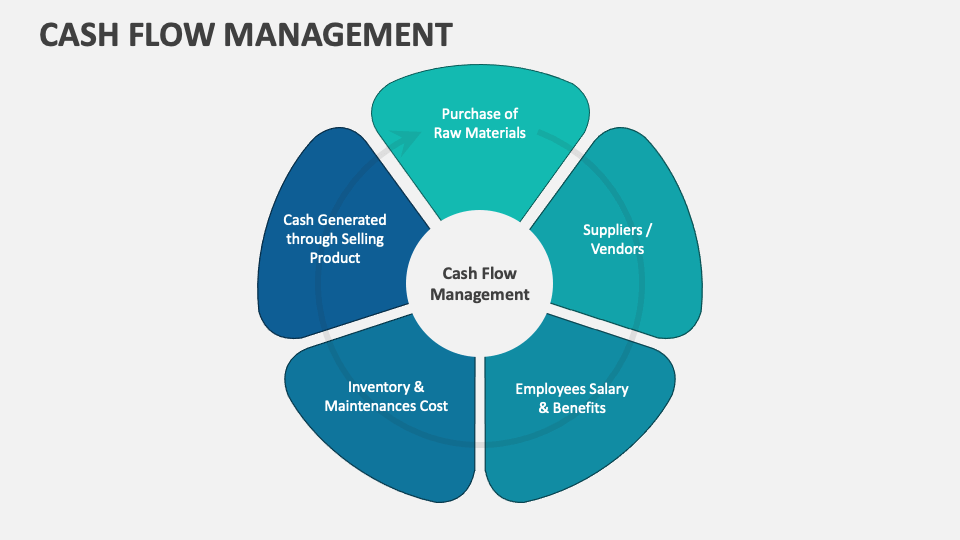

Understanding the Importance of Cash Flow Management

Cash flow represents the lifeblood of your business—it’s the movement of money into and out of your organization. Positive cash flow enables you to meet day-to-day expenses, invest in growth opportunities, and safeguard against unforeseen challenges. However, poor cash flow management can lead to liquidity problems, affecting your ability to pay suppliers, meet payroll, or seize strategic opportunities.

Key Components of Cash Flow Management

Monitoring Inflows and Outflows: Keeping track of incoming revenues and outgoing expenses.

Forecasting: Predicting future cash needs and potential shortages.

Maintaining Liquidity: Ensuring sufficient cash is available to cover operational expenses and emergency situations.

The Role of Regular Account Reconciliation

Regular account reconciliation involves matching your internal records with external statements—such as bank statements, invoices, and receipts—to verify that every transaction is accurately recorded. This process is essential for maintaining financial clarity and plays a pivotal role in effective cash flow management. Here’s how:

1. Enhanced Visibility into Cash Transactions

By consistently reconciling your accounts, you gain a clear and accurate view of every cash transaction. This enhanced visibility helps you:

Track Actual Cash Positions:

Know exactly how much cash is available at any given time.

Identify Discrepancies:

Quickly spot errors, unauthorized transactions, or timing issues that could distort your cash flow analysis.

Maintain Updated Records:

Ensure that your cash flow statements reflect real-time data, which is crucial for informed decision-making.

2. Early Detection of Liquidity Issues

Regular reconciliation acts as an early warning system for potential cash flow problems. By identifying discrepancies and errors promptly, you can:

Prevent Overdrafts:

Avoid situations where unrecorded transactions might lead to unexpected shortfalls.

Mitigate Risks:

Detect irregularities or delays in cash inflows, allowing you to take corrective measures before they escalate into significant liquidity issues.

Optimize Cash Reserves:

Adjust your cash management strategy in real-time, ensuring that your business always has sufficient liquidity to meet its obligations.

3. Improved Forecasting and Planning

Accurate, up-to-date financial records are the foundation of reliable cash flow forecasting. Regular account reconciliation enhances your ability to:

Analyze Trends:

Identify patterns in cash inflows and outflows over time, which helps in forecasting future cash needs.

Plan Investments:

Make informed decisions about capital expenditures, growth initiatives, or cost-cutting measures based on accurate cash flow projections.

Prepare for Seasonal Variations:

Anticipate periods of high and low cash activity, allowing you to plan accordingly and avoid potential liquidity crunches.

Best Practices for Using Reconciliation to Boost Cash Flow Management

To maximize the benefits of account reconciliation for cash flow management, consider the following best practices:

Implement Regular Reconciliation Cycles

Daily or Weekly Reviews:

Depending on your business volume, frequent reconciliations ensure that discrepancies are detected and resolved swiftly.

Consistent Schedule:

Establish a regular schedule for reconciliation to maintain ongoing visibility into your cash positions.

Leverage Technology and Automation

Automated Software Solutions:

Utilize advanced reconciliation software that automates the matching process, reducing manual errors and saving time.

Real-Time Integration:

Implement systems that integrate with your bank feeds and accounting software for continuous updates on your financial transactions.

Maintain Detailed Documentation

Record Discrepancies:

Keep a detailed log of any discrepancies found, along with the steps taken to resolve them.

Standardize Reporting:

Develop standardized reconciliation reports that provide clear insights into cash flow trends and areas that may require attention.

Involve Key Stakeholders

Collaborative Reviews:

Engage your finance team and management in regular reviews of reconciliation reports to discuss cash flow insights and strategic implications.

Training and Updates:

Ensure that your staff is well-trained in the latest reconciliation techniques and understands its impact on cash flow management.

How Young and Right Can Help

At Young and Right, we understand the critical connection between accurate financial records and effective cash flow management. Our comprehensive account reconciliation services are designed to provide you with the following benefits:

1 . Expert Analysis

Our experienced team meticulously reviews every transaction to ensure accuracy, helping you maintain a clear and reliable picture of your cash flow.

2 . Advanced Technology

We leverage state-of-the-art reconciliation software that automates processes, minimizes errors, and delivers real-time insights to keep you informed and agile.

3 . Customized Solutions

Recognizing that every business is unique, we tailor our reconciliation processes to fit your specific operational needs. This ensures you receive the most relevant insights for managing your cash flow effectively.

4 . Proactive Support

Beyond routine reconciliation, we offer ongoing support and strategic advice. Our proactive approach helps you optimize your cash flow, plan for future growth, and prevent liquidity issues.

5 . Regulatory Assurance

We ensure that all our processes comply with the latest UAE financial regulations and industry standards, reducing risks and building trust with your stakeholders.

6 . Long-Term Partnership

At Young and Right, we value building lasting relationships. We work closely with you over the long term, continually refining our services to adapt to your evolving business needs and supporting your financial success.

Conclusion

Regular account reconciliation is more than a routine financial task—it’s a strategic tool that can transform your cash flow management. By ensuring accurate, real-time financial records, you gain the visibility and control needed to avoid liquidity problems, forecast future cash needs, and make informed decisions that support your business’s growth and stability.

For businesses in Dubai, where market dynamics are fast-paced and competitive, leveraging the power of precise account reconciliation is essential. Partner with Young and Right to harness expert financial oversight, advanced technological integration, and customized solutions that enhance your cash flow management and secure your financial future.