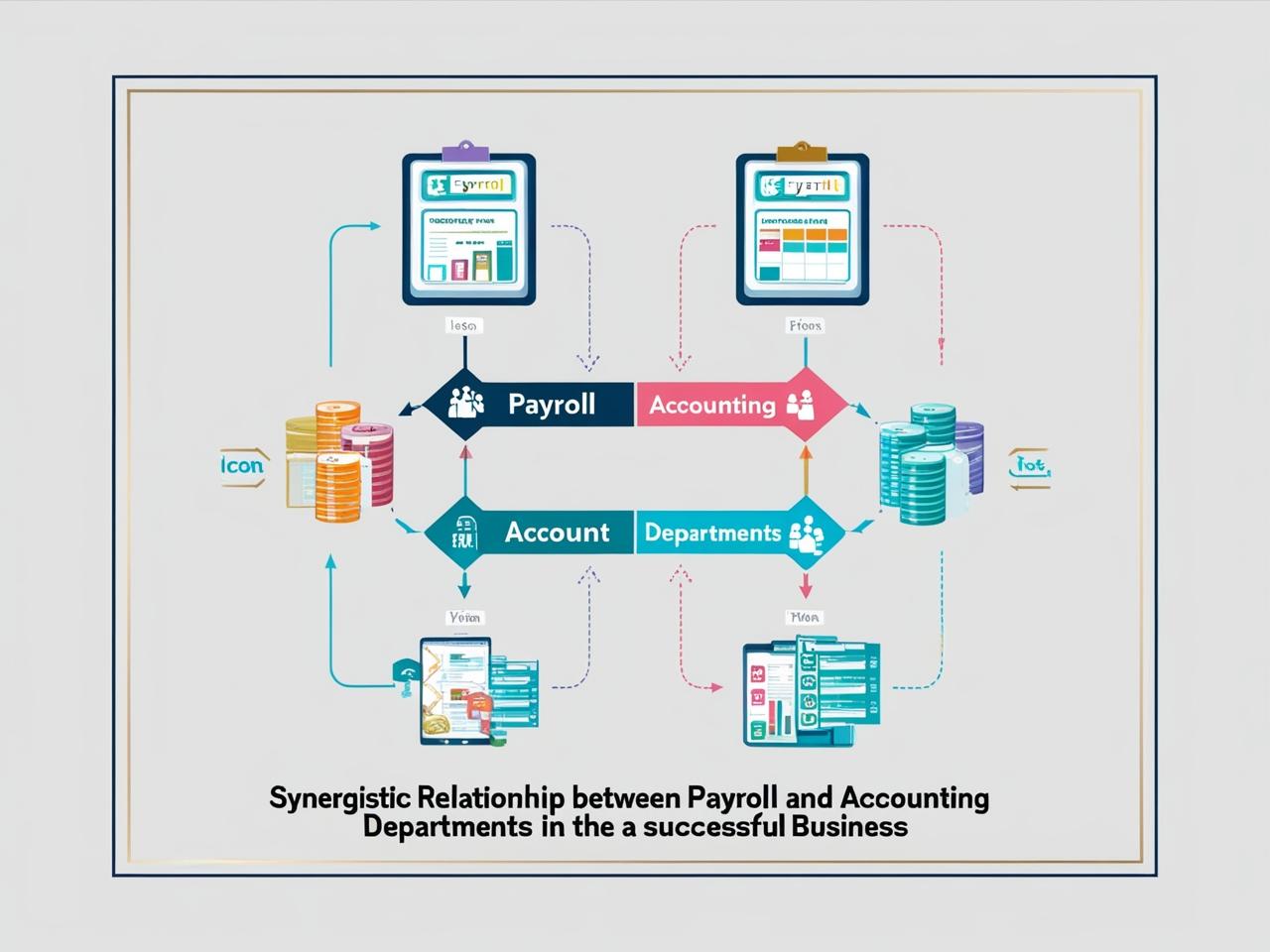

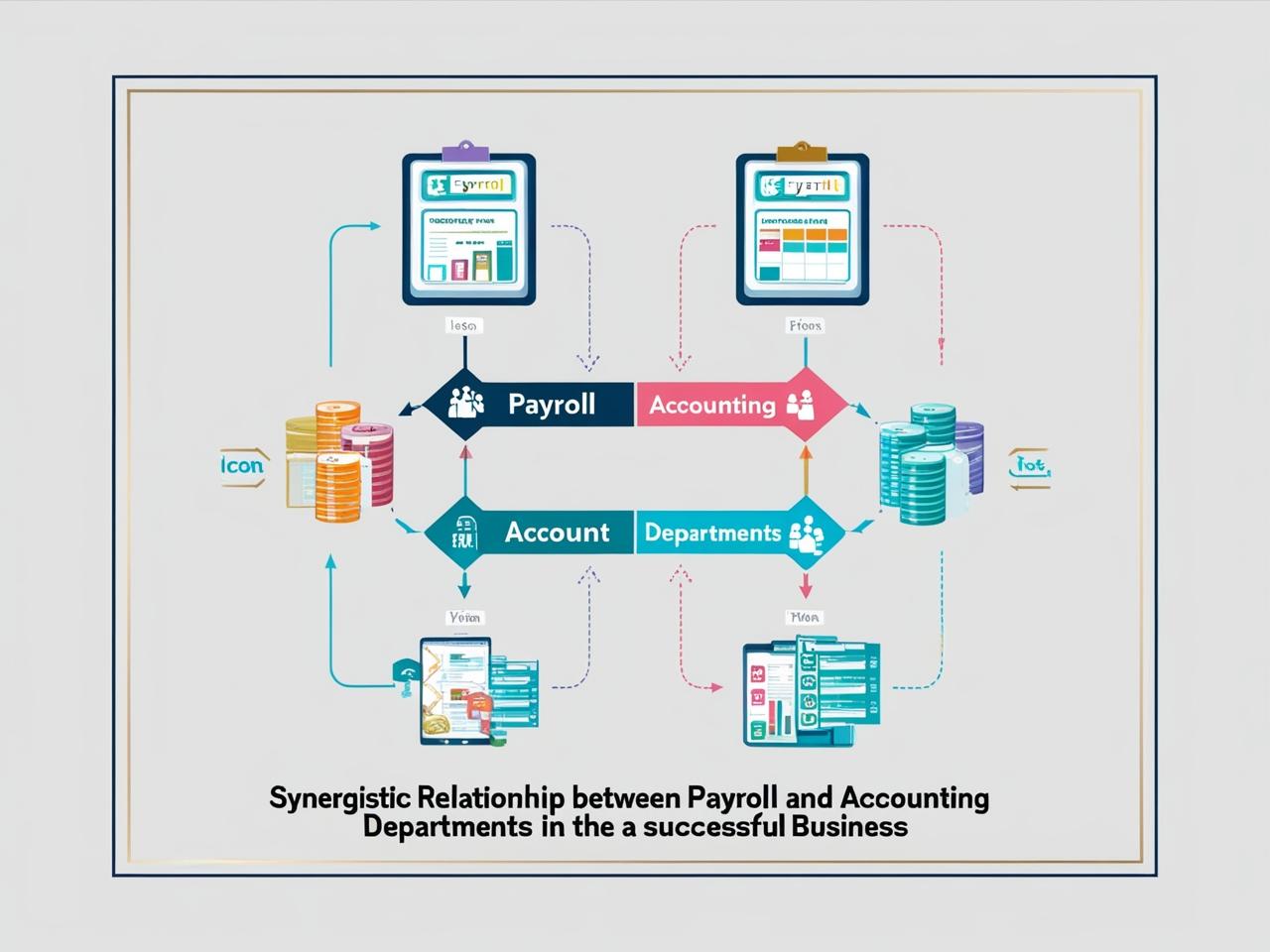

Payroll and Accounting: How They Work Together for Business Success

Link Between Payroll and Financial Reporting

Payroll and accounting are two essential business functions that are intricately connected, and their alignment is crucial for a company’s financial health. Payroll management involves calculating and disbursing employee wages, benefits, and deductions, while accounting focuses on recording, summarizing, and reporting financial transactions. Together, they ensure that employees are paid on time, and the company’s financial statements reflect the true cost of labor.

The relationship between payroll and accounting goes beyond just processing salaries; it impacts key financial statements such as the balance sheet, income statement, and cash flow statement. Payroll costs—including wages, benefits, and taxes—are one of the largest expenses for most businesses, and they need to be accurately reflected in financial reports to ensure the company remains compliant and fiscally responsible.

How Payroll Affects the Balance Sheet

The balance sheet is one of the fundamental financial statements, showing a company’s assets, liabilities, and equity at a given point in time. Payroll-related costs, such as salaries payable, employee benefits, taxes, and wages, all affect a company’s liabilities. These costs must be recorded accurately to reflect the correct amount owed to employees and the government. If payroll liabilities are not correctly accounted for, the balance sheet can misrepresent the company’s financial position.

For example:

* Salaries Payable: The amount the company owes employees for work already completed but not yet paid, will be recorded as a liability on the balance sheet.

* Payroll Taxes: The company must also account for employee payroll taxes that need to be paid to the government. This can include social security contributions, income tax, and other deductions.

The Impact of Payroll on Other Financial Reports

* Income Statement: Payroll expenses are typically the largest operating costs for most businesses. These expenses need to be accurately recorded on the income statement under operating expenses to measure profitability.

* Cash Flow Statement: Payroll payments (both salary disbursements and tax payments) affect cash flow. Timely payment of wages will reduce available cash reserves, which is an important consideration in cash flow management.

Coordination Between HR and Accounting

The Human Resources (HR) department and accounting team must work closely together to ensure smooth payroll processing and accurate financial reporting. While HR manages employee data, employment contracts, benefits, and leave balances, accounting is responsible for ensuring that all payroll-related transactions are accurately recorded and reported.

Key Points of Coordination:

* Employee Data Sharing: HR maintains employee records such as pay rates, working hours, benefits entitlements, and tax status, which are essential for payroll calculations. This data must be transferred accurately to the accounting team to ensure the financial records reflect employee payments correctly.

* Payroll Deductions and Benefits: HR is responsible for calculating and managing employee benefits, such as overtime, bonus pay, and leave entitlements, while accounting ensures that these costs are accurately reflected in the financial statements. Additionally, HR needs to track employee deductions like health insurance premiums, pension contributions, and taxes, which accounting must report as liabilities.

* Compliance: Both HR and accounting must stay up-to-date on regulatory changes regarding labor laws, taxation, and employee benefits. This ensures that payroll calculations align with the latest regulations, and the company stays compliant with government requirements.

How Payroll Affects Financial Decision-Making

For effective financial decision-making, HR and accounting must collaborate to provide accurate and timely payroll reports. Accounting can analyze payroll expenses as part of the overall business cost structure, helping management understand profit margins, cash flow, and the financial impact of employee-related costs.

Software Solutions That Connect Payroll and Accounting

In today’s digital age, many companies rely on automated software solutions to manage payroll and accounting processes. These systems are designed to seamlessly integrate the two functions, making it easier to manage employee compensation, track expenses, and maintain accurate financial reports. Here are some of the most commonly used payroll and accounting software solutions:

1. Integrated Payroll Software

Software like QuickBooks, Xero, and Zoho Payroll offer integrated payroll features that automatically sync payroll data with accounting records. This integration ensures that:

* Salary payments are recorded accurately in financial statements.

* Payroll liabilities, including taxes and benefits, are correctly accounted for in the balance sheet.

* Financial reports are generated with payroll data included, offering a comprehensive view of company expenses.

2. Cloud-Based Payroll Systems

Cloud-based payroll systems provide a centralized platform for businesses to manage both payroll and accounting. These systems allow for real-time payroll processing and provide instant access to payroll data, enabling business owners and managers to make informed decisions based on current financial information.

3. Payroll and HR Software

Many businesses now use integrated HR and payroll solutions like ADP, Paychex, and Gusto. These platforms allow for seamless coordination between HR and accounting, reducing the chances of data discrepancies. They handle everything from employee onboarding to payroll tax calculations and generate detailed reports for both departments to use.

4. Accounting Systems with Payroll Modules

Some accounting platforms, such as Sage and Microsoft Dynamics, offer payroll modules that allow businesses to handle payroll directly within the accounting system. These solutions make it easier to integrate payroll data with financial reporting, saving time and ensuring consistency across departments.

How Young and Right Can Help

At Young and Right, we offer integrated payroll and accounting services to help businesses streamline their payroll processes and maintain compliance with UAE labor laws and tax regulations. Here’s how we can assist:

1. Seamless Integration with Accounting Systems

We work with leading payroll and accounting software to integrate your payroll data with your financial reports. This ensures that your payroll expenses are accurately recorded in your balance sheet and income statement and helps reduce errors.

2. Expert Payroll Management

Our team handles all aspects of payroll processing, including salary calculations, benefit deductions, WPS compliance, and end-of-service benefits. We ensure that your payroll is processed accurately, on time, and in full compliance with UAE regulations.

3. Real-Time Reporting and Access

Using cloud-based payroll systems, we provide businesses with real-time access to payroll data and reports. This allows business owners and managers to make informed financial decisions and ensures transparency in payroll management.

4. Tailored Payroll Solutions

We offer custom payroll solutions tailored to the specific needs of your business. Whether you’re a small business, SME, or large corporation, we provide payroll services that align with your company’s size, industry, and growth trajectory.

5. Compliance and Tax Filing

We ensure that your payroll complies with the latest UAE labor laws, tax regulations, and WPS requirements. Our team also assists with tax filings and generates reports that can be submitted to regulatory authorities, reducing the burden on your internal teams.

6. Dedicated Customer Support

Our payroll experts are available to assist you with any payroll-related queries or concerns. We provide dedicated support to help businesses navigate the complexities of payroll management and ensure compliance with the law.

Conclusion

Payroll and accounting go hand in hand when it comes to managing business finances. Effective coordination between payroll and accounting ensures that employee compensation is handled accurately, and financial reports are complete and compliant with regulatory standards. By integrating payroll and accounting systems, businesses can improve efficiency, reduce errors, and make more informed financial decisions.

At Young and Right, we offer integrated payroll and accounting solutions that help businesses manage both functions seamlessly. Our cloud-based systems, expert payroll management, and compliance support ensure that your business runs smoothly while meeting all regulatory requirements.